How did Norway become a global leader in electric vehicles?

In 2021, nearly 65% of passenger car sales in the Norwegian market will come from pure electric vehicles and another 22% from plug-in hybrid vehicles. This means that Norway's electric vehicle market share was as high as 86.2% last year, higher than any other country in the world.

So how did Norway become a global leader in electric vehicles? Not because of the right geography, much less because Norwegians are greener or more concerned about climate change, but it can be attributed to the demand-side policy that has been going on in the country for a long time.

Pioneering the unique car tax system

Since 1990, the Norwegian government has created a package of incentives for the promotion of zero-emission vehicles, as shown in the figure below:

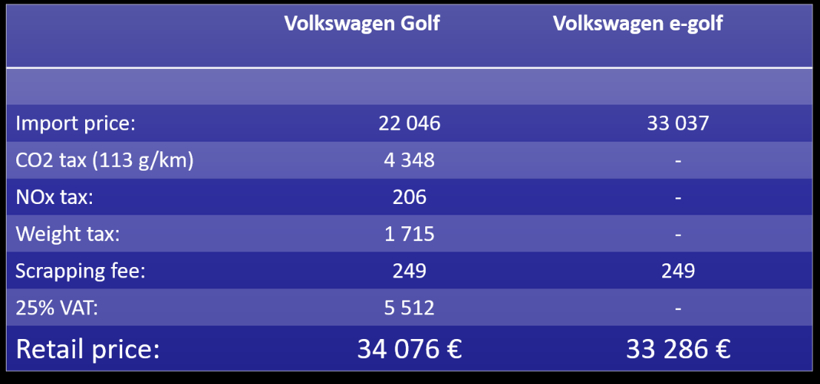

For Norwegian car consumers, there are no acquisition or import taxes when buying or leasing an electric car, no tolls etc. when using an electric car, and a range of privileges (free parking, etc.); Fuel vehicles need to pay 25% value-added tax and emission fees. Under a series of policies, electric cars in Norway are generally more affordable than gasoline-powered cars.

For example, according to Volkswagen's official price list in Norway, the gasoline version of the Golf costs 22,046 euros for import, subject to additional CO2 tax of 4,348 euros, car weight tax of 1,715 euros, and value-added tax of 5,512 euros, etc. After taxes and fees, the final purchase cost of the car was 34,076 euros; while the import price of the e-Golf was 33,037 euros, higher than the gasoline version, but with less taxes and fees, the final purchase cost was 33,286 euros.

As Christiana Bu, secretary general of the Norwegian EV Association, said: “Nowadays, buying a new electric car is about the same price as buying a decent petrol or diesel car.” Plus, that doesn’t take electric cars into account. Lower running and "fuel" costs.

Looking back at Norway's electric vehicle policy over the past three decades, we can see three key points. First, initially, the Norwegian government's incentives for buying, owning and using electric vehicles are effective measures to increase penetration; second, these incentives do not have to be continuous, but can be gradually reduced as penetration increases; Finally, a more EV-friendly tax structure could effectively boost EV purchases.

Sufficient charging infrastructure to back up

In addition to rolling out electric vehicle incentives, Norway has also invested in state-of-the-art charging infrastructure to support the transition to more sustainable electric vehicles. Initially, Oslo has been a testing center for Norway's new infrastructure, and in 2008 launched the first municipal electric vehicle charging system. By 2015, Norway had 10,000 charging stations. However, after reaching 72,000 electric vehicles, Norway quickly realized that it needed to further accelerate the development of electric vehicle charging infrastructure to build on the success of the tax incentives.

Since then, the Norwegian government has increased the number of EV chargers, pledging to have at least one fast-charging station every 50 kilometers on major highways and offering subsidies to suppliers to speed up installations. By 2017, Norway had successfully increased the number of EV charging points on these key routes from 300 in 2014 to around 1,500, and installed the first supercharger in rural Nebbenes, capable of charging 28 vehicles simultaneously. Electric car charging. Currently, there are more than 15,000 public charging stations in Norway. On a larger scale, while Norway has only 1% of the EU population, the country has almost 8% of the EU's public charging stations.

Norway has also adopted a different strategy from other countries when it comes to charging residential EVs. Several Norwegian cities have launched funding schemes to support the development of charging stations for housing cooperatives.

Norway’s support for infrastructure also includes commercializing transport, and in 2018 Norwegian taxis were already able to use wireless charging, reducing the time it takes to find a charger, plug it in and wait for a charge. The inductive technology uses a charging pad mounted on the road of a taxi bay, linked to a receiver mounted inside the taxi, to make charging more efficient.

For now, the Norwegian EV market shows no signs of slowing down. All taxis in Norway will be zero-emissions by 2023, and a wireless charging system will help make that happen. In addition to this, Norway is working towards its main goal of all new cars sold by 2025 being zero-emissions (either pure electric or hydrogen), making Norway the first country in the world to "ban combustion".

China's electric vehicle testing ground

By introducing incentives early, rapidly expanding infrastructure, and continuing to develop technologies such as wireless charging to meet demand, Norway has developed an ecologically conscious society where Norwegians see electric vehicles as an easier and natural choice. As a result, Norway has become a testing ground for Chinese electric vehicles.

Currently, more than a dozen Chinese automakers are exporting or are about to export electric models to Europe and the United States, most of which use Norway as a testing ground, including BYD, NIO, Xpeng, and SAIC, all of which are targeting the Norwegian market. Electric cars were launched.

China's Weilai, Xiaopeng and other independent companies regard Norway as the first stop to enter the European market, mainly for three reasons. The first is because of the advantages of the Norwegian market itself. The high degree of transformation, the perfect related infrastructure, and the high level of consumer acceptance make it a good testing ground.

The second point is that Norway has no homegrown automakers, so all foreign brands are equal here. China itself has an early layout in the field of new energy vehicles. At present, it has obvious advantages in product research and development, quality verification, and the layout of power batteries and other industrial chains. It has also given local car companies the courage to enter the Norwegian market.

Third, compared to sales in the Norwegian market, Chinese car companies hope to leverage the experience and brand recognition accumulated in the mature Norwegian market to open up the European market. By studying and adapting to the Norwegian market, car companies can lay the foundation for future expansion into the wider European market. As Rolf Almklov, Commercial Counselor of the Norwegian Embassy in Beijing, said, "If Chinese car companies do well in Norway, it will be a good sign for all other European markets."

XINDA

XINDA