![]()

Regional Competition Landscape of Global Industrial Motor Technology

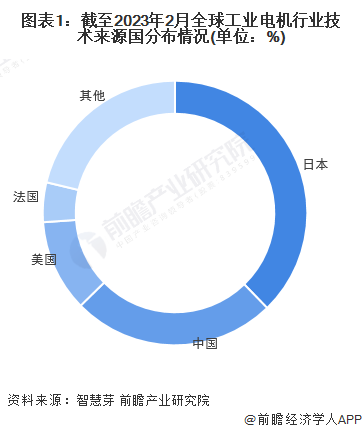

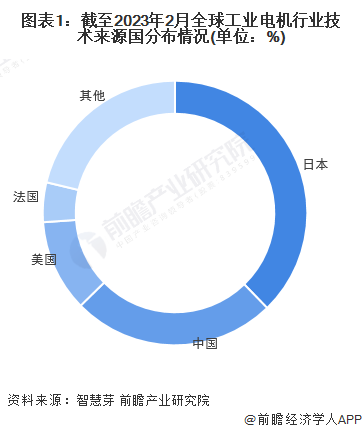

——The distribution of technology sources in the global industrial motor industry: Japan has the highest proportion of patent applications

At present, the world's largest source of industrial motor technology is Japan, and Japan's industrial motor patent applications account for 38% of the global industrial motor patent applications; followed by China, industrial motor patent applications account for 25% of the global industrial motor patent applications. %; The third place is the United States, and the number of industrial motor patent applications accounts for 11% of the global industrial motor patent applications.

Statistical description: ①Statistics are performed according to the de-duplication rules for displaying one public text per application, and the latest text on the public date is selected for calculation. ②Statistics are made according to the country of patent priority, and if there is no priority, it is calculated according to the country of the receiving office. If there are multiple priority countries, the calculation will be based on the earliest priority country.2) Patent application trends in the global industrial motor industry: In recent years, the number of patent applications for industrial motors in China has taken the lead

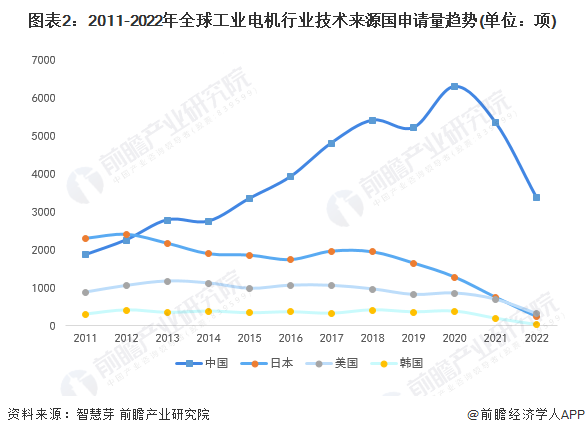

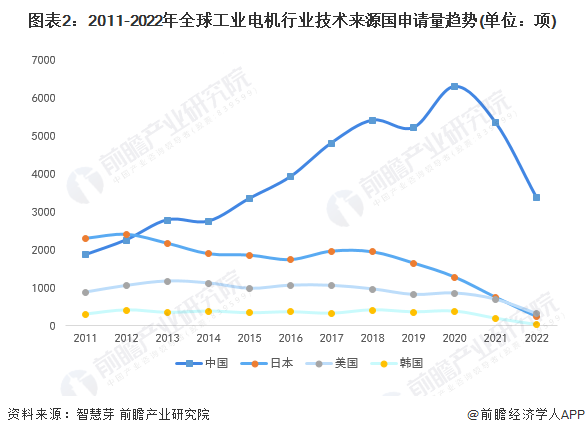

Judging from the trend of the number of applications from the countries of origin of technology in the global industrial motor industry, from 2011 to 2022, the number of patents for industrial motors in China has increased year by year, while the number of patent applications for industrial motors in Japan and the United States has declined in recent years. In 2022, the number of patent applications for industrial motors in China will be 3,361, 230 in Japan, and 310 in the United States.

Statistical description: ①Statistics are performed according to the de-duplication rules for displaying one public text per application, and the latest text on the public date is selected for calculation. ②Statistics are made according to the country of patent priority, and if there is no priority, it is calculated according to the country of the receiving office. If there are multiple priority countries, the calculation will be based on the earliest priority country.3) Regional distribution of patent applications in China's industrial motor industry: the number of patent applications for industrial motors in Jiangsu Province reached 10,100

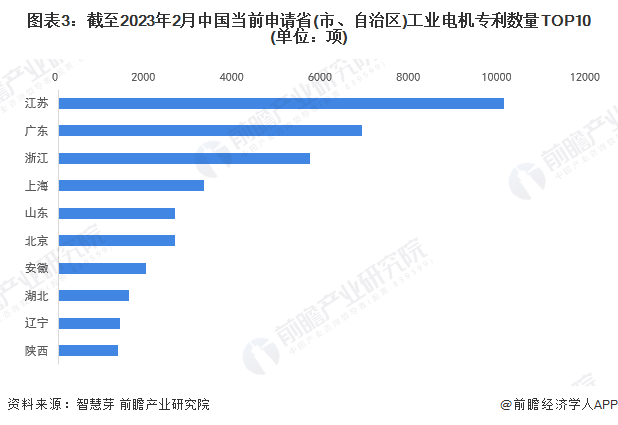

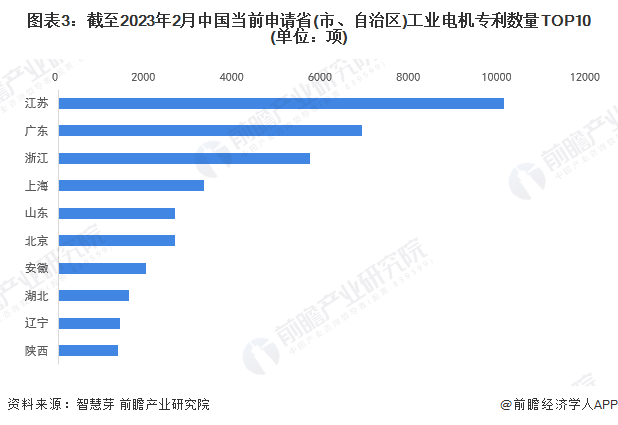

In terms of the number of patent applications in various regions of China, Jiangsu Province is currently the province with the largest number of industrial motor patent applications in China, and the cumulative number of industrial motor patent applications is as high as 10,100. The second place is Guangdong Province, with a total of 6,887 patent applications for industrial motors. The top ten provinces and cities include Zhejiang Province, Shanghai City, Shandong Province, and Beijing City.

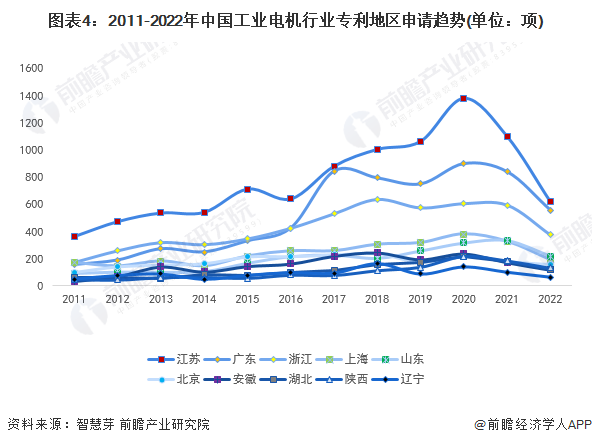

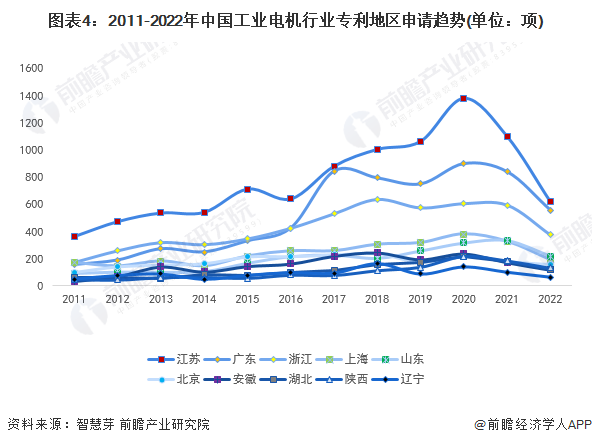

Statistical caliber description: Statistics are based on the address submitted by the patent applicant.From the perspective of the application trend of patent areas in the industrial motor industry, from 2011 to 2022, the number of industrial motor patent applications in some provinces and cities showed an overall upward trend, among which Jiangsu Province ranked first, and the number of applications has grown rapidly in recent years, with the highest peak in 2020 , the annual number of relevant patent applications exceeds 1,300 , and the statistics in 2022 will be 618.Statistical caliber description: Statistics are based on the address submitted by the patent applicant.

, and the statistics in 2022 will be 618.Statistical caliber description: Statistics are based on the address submitted by the patent applicant.

Competitive landscape of major patent applicants in the global industrial motor industry

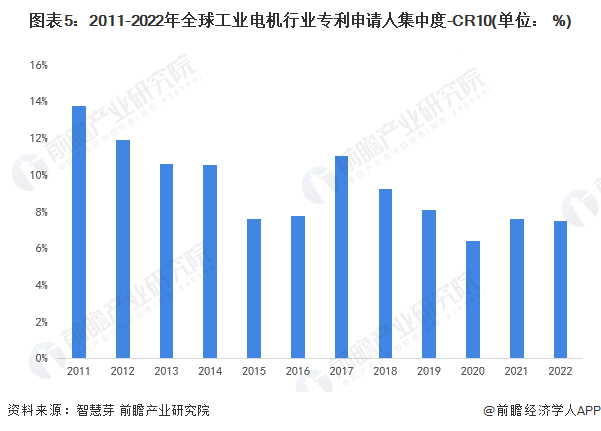

——Concentration of patent applicants in the global industrial motor industry: the market concentration is not high, and the fluctuation of CR10 has decreased

From 2011 to 2022, the CR10 of global industrial motor patent applicants showed a downward trend in fluctuations, from 13.77% in 2011 to 7.46% in 2022. Overall, the concentration of global industrial motor patent applicants is not high.

Statistical caliber description: Market concentration—CR10 is the ratio of the patent applications of the top 10 applicants in the total number of applications to the total number of patent applications in this field (among them, when there is a joint application, the number of patents will not be de-duplicated. ).2) Status of TOP10 patent applicants in the global industrial motor industry(1) Total distribution of patent applicants in the global industrial motor industry: Panasonic Industrial Co., Ltd. won the crown

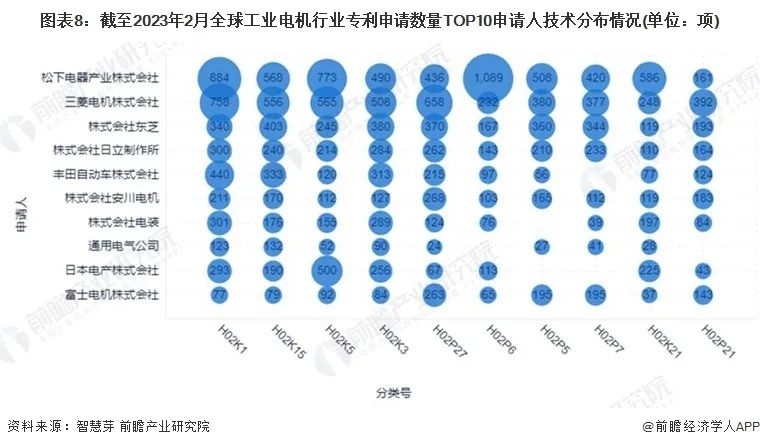

The top 10 applicants for the number of patent applications in the global industrial motor industry are Panasonic Corporation, Mitsubishi Electric Corporation, Toshiba Corporation, Hitachi Corporation, Toyota Motor Corporation, Yaskawa Electric Corporation, Denso Corporation, and General Motors Corporation Electric company, Nidec Corporation, Fuji Electric Corporation.

Among them, Matsushita Electric Industry Co., Ltd. has the largest number of industrial motor patent applications, about 6,000. Mitsubishi Electric Corporation ranked second, with about 4,200 industrial motor patent applications.

Note: The number of joint applications has not been excluded.In terms of trends, among the top ten industrial motor patent applicants in the world, the number of patent applications of Panasonic Electric Industrial Co., Ltd., which ranks first in the total number of patent applications, has dropped significantly in recent years, while the number of applications for General Electric and Nidec Corporation has decreased in recent years. There has been an increase, and there was a peak in the number of applications in 2017. In 2022, the number of patent applications of Denso Corporation, General Electric Company, and Nidec Corporation is relatively high, 28, 26, and 18, respectively.

(2) Distribution of patented technologies of applicants in the global industrial motor industry: H02K1 is a popular patented technology among TOP10 applicantsAt present, the technologies of the top 10 applicants in the number of patent applications in the global industrial motor industry are mainly deployed in the subdivision of "H02K1 magnetic circuit components". The company with the largest number of this technology is Panasonic Industrial Co., Ltd. Panasonic Industrial Co., Ltd., which has the largest number of patent applications for industrial motors in the world, has applied for 884 patents in the H02K1 segment.3) The applicants of the TOP10 patents with the highest market value in the global industrial motor industry: Black & Deck owns the patents with the highest value

Among the TOP10 patents with the highest value in the global industrial motor market, the most valuable is Black and Dyke, whose patent "US20220255490A1 battery pack and its manufacturing method" is worth up to 12.2 million US dollars; Tesla's "JP7012031B2 motor rotor discharge protection "The value of the patent is $11.89 million.

Note: The most valuable patent refers to the simple family with the highest patent value in the technical field. The current statistical caliber is based on the deduplication rules of one patent representative for each simple family, and any patent with patent value in the same family is selected for display.

, and the statistics in 2022 will be 618.

, and the statistics in 2022 will be 618.

XINDA

XINDA