![]() First look at a set of numbers:

First look at a set of numbers:

About 50% of the world's electricity consumption is consumed by motors.

If the efficiency of the motor is increased by 10%, about 100 nuclear power plants can be replaced.

From this proportion of power consumption, what conclusions can we deduce? That is the era of carbon neutrality, and the market concentration of the motor industry will be even higher.

In the past, people did not pay much attention to carbon neutrality, so many customers will buy high energy consumption but low price motor products according to the price. In the future, in the era of carbon neutrality, energy consumption will also become a hard indicator. If the energy consumption is not enough, the price is too cheap and customers will not purchase it.

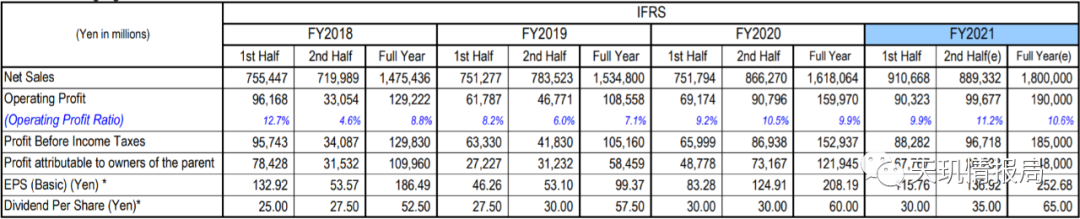

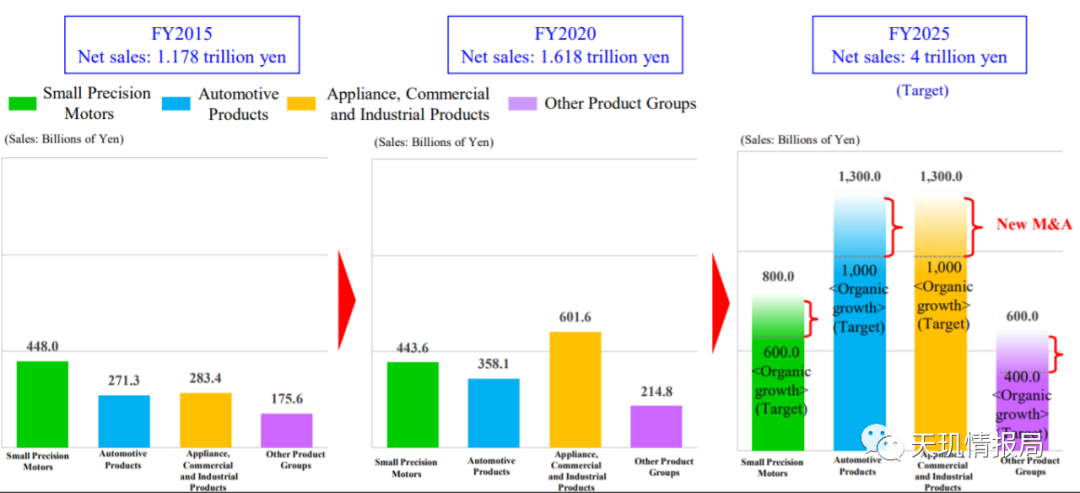

In this case, the market concentration of the motor industry is destined to continue to increase.Let’s look at Nidec, the world’s largest motor giant , with a current market value of more than 300 billion yuan, and a market value of up to 450 billion yuan in the past two years.Looking at its financial report, in the past four years, from 2018 to the present, its revenue has increased year by year, and the new crown epidemic has not had a major impact on it. Profit only declined in 2019, and the profit margin in 2020 exceeded 2018.Nidec's annual report deadline is the first quarter. Its 2021 Q3 financial report deadline is December 31. According to its 2021 Q3 financial report, both revenue and profit are good. Therefore, the strong are often strong.The most surprising thing about Nidec is its strategic goal: its revenue in 2020 is 88 billion yuan, and its revenue target for 2025 is 220 billion yuan.It is already the largest elephant in the industry, and it needs such a rapid growth rate.If such a high sales volume is to be achieved, the growth will mainly come from two areas, automobiles and home appliances.

Especially with the outbreak of electric vehicles, the potential for electric drive of automobiles is great. At present, automotive motors are Nidec's third largest source of revenue, and it hopes to become the largest source of revenue in the future.

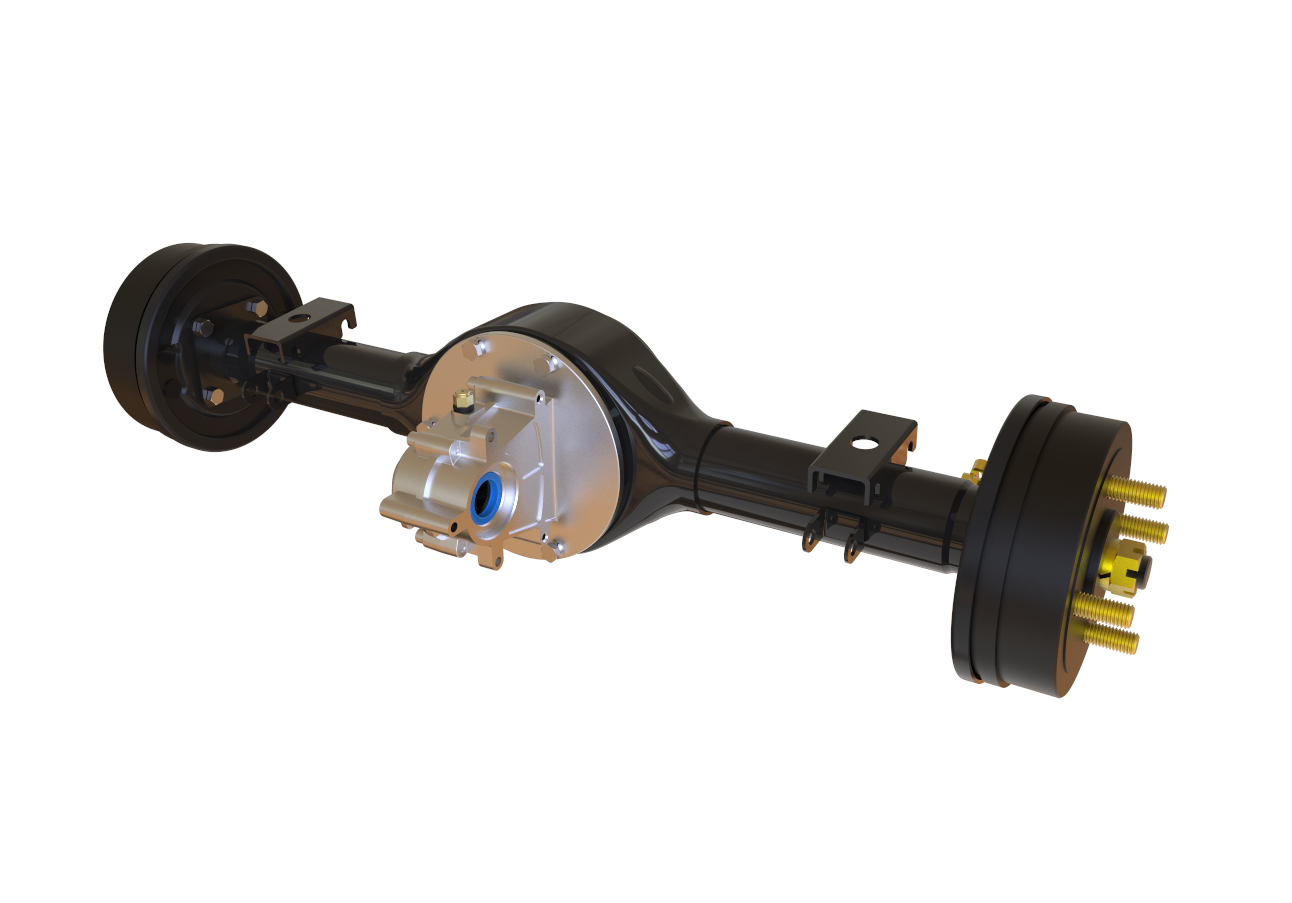

There is a very interesting picture in Nidec's financial report, which is worth thinking about:It believes that after 2025, the global electric vehicle industry chain will focus more on outsourcing rather than in-house production. It believes that eventually (around 2050) the electric vehicle industry will establish an industrial chain structure based on horizontal division of labor, similar to the supply chain structure of the past fuel vehicle era.At present, many electric vehicle manufacturers are developing their own core components such as electric drives, which means they have adopted a vertically integrated business model.The business history of many industries, including computers and semiconductor chips, tells us that in the early stages of the industry, the industry chain was immature, and the giants mostly adopted the vertical integration model. Later, as the industry chain matured, the giants also began to turn to the horizontal division of labor model.So, is the horizontal division of labor model invincible? No, the most NB giants in the industry will still try the vertical integration model. For example, Apple and Tesla now.However, we can use common sense to deduce that the current model of many second- and third-rate electric vehicle companies trying to vertically integrate core components will definitely be eliminated. The reason is simple. The scale effect is not as good as that of third-party parts giants.Who will become the No. 1 driving motor giant in the field of electric vehicles in the world in the future? At present, the market value of A-share motor leaders is generally in the range of several billion to more than 10 billion. Do they have a chance? It’s hard to say now, but it is foreseeable that this track should give birth to a car electric drive giant with a revenue of hundreds of billions of yuan. In 2021, the production and sales of new energy vehicles in China will exceed 3.5 million, a year-on-year increase of 1.6 times, ranking first in the world for seven consecutive years, and the cumulative promotion volume has exceeded 9 million. New energy vehicles play a pivotal role in the strategic choice for the high-quality development of China's auto industry and China's important measures to achieve the "double carbon" goal. With the advantages of high power density, high operating efficiency, simple and compact structure, large and smooth torque, and good speed regulation performance, permanent magnet synchronous motors have occupied an absolute mainstream position in the domestic new energy vehicle drive motor market. According to GGII data, the installed capacity of permanent magnet synchronous motors will account for as high as 94% in 2021; in 2021, the top five domestic drive motor installed companies are BYD/Tesla/Founder Motor/Ningbo Shuanglin/ For Weiran Power, the installed volume is 62/40/25/20/180,000 units, accounting for 18%/12%/7%/6%/5%. Benefiting from the rapid growth of new energy passenger vehicles, the improvement of motor performance and the increase in the proportion of dual-motor configuration models, the analysts of the agency predict that the market space for new energy passenger vehicle drive motors is expected to reach 38.5 billion yuan in 2025.

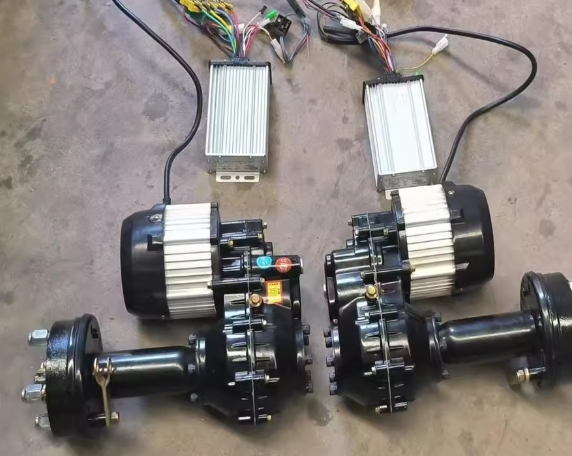

Development trend: flat wire, oil cooling, all-in-oneCompared with the traditional round wire motor, the flat wire motor can increase the full rate of the bare copper slot by 20%-30%, the total copper consumption has decreased by 21%, and the efficiency has increased by about 1%;Under the oil cooling technology, the cooling oil can directly contact the heating parts of the motor, and the heat dissipation efficiency is much higher than that of the traditional water cooling system, and the oil medium has the advantages of good insulation, high dielectric constant, low freezing point and high boiling point. The drive motor of BYD DMI adopts direct injection rotor oil cooling technology, which can increase the power density of the motor by 32%The all-in-one electric drive system integrates components such as motors, reducers, and controllers, and shares parts such as housing wiring harnesses to achieve integration, cost reduction, and light weight. The gap between the flat copper wires of the flat wire motor is large, and the cooling oil is easy to penetrate, which promotes the application of direct oil cooling technology. At the same time, the cooling oil has good insulation and can be reused in multiple scenarios, which accelerates the integration process of the vehicle's thermal management system and promotes the popularization of the all-in-one electric drive system assembly.Benchmarking companies: Tesla and BYD continue to innovate, and third-party motor manufacturers make rapid progressTesla uses a built-in permanent magnet synchronous reluctance motor to alleviate the limitations of permanent magnet motors under high speed conditions, adds a carbon fiber protective layer to the motor rotor with excellent production technology, and develops a 10-layer flat wire winding motor.BYD adopted the technical solution of front-drive induction asynchronous motor + rear-drive permanent magnet synchronous motor on the E platform 3.0, and landed the world's first eight-in-one powertrain. BYD's EHS electric hybrid system on the plug-in hybrid system adopts an integrated design of dual motors + dual electric controls. The power density of the flat-line oil-cooled motor has increased to 44.3KW/L, and the volume and weight have been reduced by 30%.In addition, BYD drives the permanent magnet to rotate through the ring gear structure, which alleviates the problem of field weakening control of the permanent magnet synchronous motor.High-quality third-party motor manufacturers such as Jingjin Electric, Inovance Technology, Juyi Technology, Founder Motor, and Dayang Motor have developed and mass-produced their own electric drive products.Recommended target: a high-quality third-party electric drive system supplierJingjin electric: experts run the enterprise, independent research and development, enter the supply chain of Xiaopeng. Founder Motor: Customer development is smooth, and the growth of the motor leader is accelerating. Juyi Technology: Intelligent equipment and electric drive system go hand in hand. Dayang Motor: a comprehensive layout, a high-quality supplier of global motor and drive control systems.

XINDA

XINDA