What is the barrier to penetration rate of electric vehicles in China?

An indicator to measure the new energy vehicle market, the penetration rate, has recently reached about 25%, that is, almost every 4 vehicles sold are new energy vehicles. Will penetration continue to rise? How high will it reach in the end?

Part1

Reality runs faster than plans

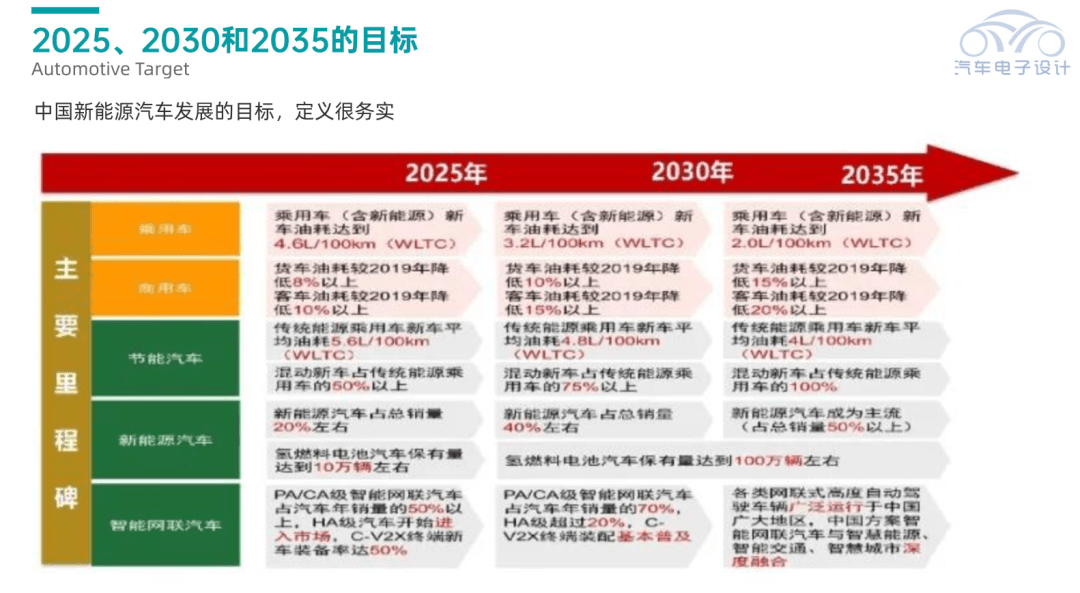

Regarding the penetration rate, our country has formulated corresponding goals:

● In October 2020, the "Energy Saving and New Energy Vehicle Technology Roadmap 2.0" compiled by the Society of Automotive Engineers of China was released, revising the penetration rate target of new energy vehicles in 2025 to 20% .

● In November 2020, the "New Energy Vehicle Industry Development Plan (2021-2035)" issued by the General Office of the State Council also mentioned that by 2025, the average power consumption of new pure electric passenger vehicles will drop to 12.0 kWh/100 km , The penetration rate of new car sales is about 20% .

But the reality ran much faster than the plan. Taking the past October as an example, the sales volume of new energy vehicles was 446,800 units; the total sales volume was 1.655 million units, and the penetration rate was 26.9%. Judging from the weekly data, as of November 13, the total sales volume of new energy vehicles this year was 4.2 million units, and the total sales volume of vehicles was 17.09 million, with a penetration rate of 24.5%. No matter from which dimension, we not only reached the target three years ahead of schedule, but also far exceeded the target value of 20%.

So what we want to ask is, where is the ceiling of China's electric vehicle penetration rate? At this rate, can we completely abandon fuel vehicles around 2030?

Part 2

Penetration rate analysis of models in different price segments

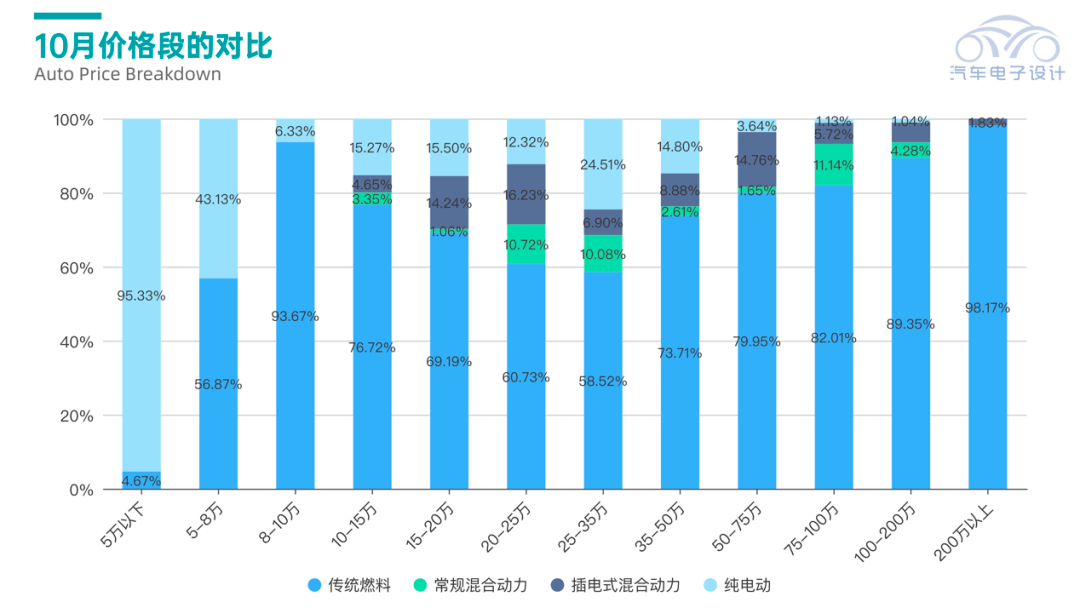

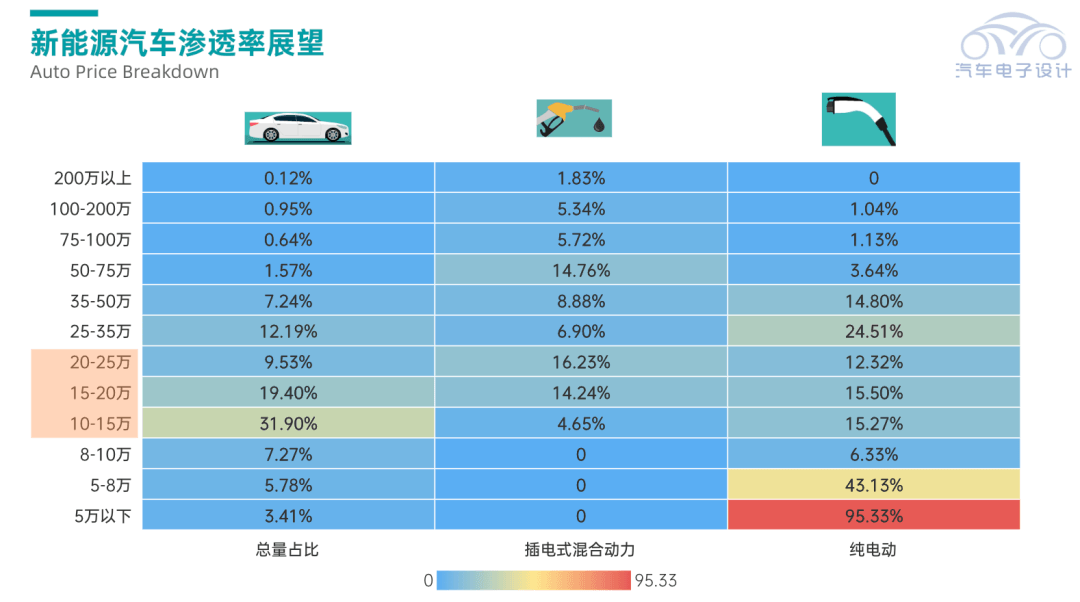

Let's analyze the models in different price segments first. The penetration rate of new energy vehicles (HEV, PHEV and BEV) is in the following price segments:

◎ 95.33% below 50,000

◎ 50,000-80,000 43.13%

◎ 80,000-100,000 6.33%

◎ 100,000-150,000 23.28%

◎ 150,000-200,000 30.81%

◎ 200,000-250,000 39.27%

◎ 250,000-350,000 41.48%

◎ 350,000-500,000 26.29%

◎ 500,000-750,000 20.05%

Due to the rise in raw material prices in 2022, new energy vehicles will actually be adjusted upwards. We can still see that the penetration rate is still increasing against the background of price increases, but the most important growth is still through A00-class cheaper models. of. But in the future, users who are willing to accept high-priced trams will decrease, and it will become difficult to occupy the market with pure electricity alone.

Let's take a look at the possibility of breakthroughs in several price segments:

● In 2022, new energy vehicles will have a breakthrough in the 100,000-250,000 market . The most obvious thing here is that the plug-in has risen from more than 50,000 per month to 120,000 to 140,000 per month. This price segment covers three main markets of 100,000-150,000, 150,000-200,000, and 200-250,000. Next year, with the efforts of Changan, Haval, Chery and Geely, new energy vehicles at this price will be beneficial to fuel vehicles. Strong substitution ability.

● But below 100,000 yuan , the ceiling of new energy vehicles seems to have come earlier. This market is originally based on transfer payments. As major companies begin to focus on gasoline vehicles and hybrid vehicles, fuel consumption points have declined. The current market is only 1 -2 car companies are willing to continue to do so. For new energy vehicles under 100,000, buy them and cherish them.

● In the 250,000-350,000 market , it can be said that Tesla is the main force and representative. In fact, Tesla’s performance this year is average, but it is expected that the price will continue to drop next year, and the penetration rate will maintain or increase slightly.

● The market of RMB 350,000-500,000 and higher is a bit like a small imperial court in the Southern Song Dynasty - in this relatively high-margin price range, car companies can settle down and maintain profits, but from the perspective of purchasing, it is difficult to continue in the market Pioneering growth.

Part3

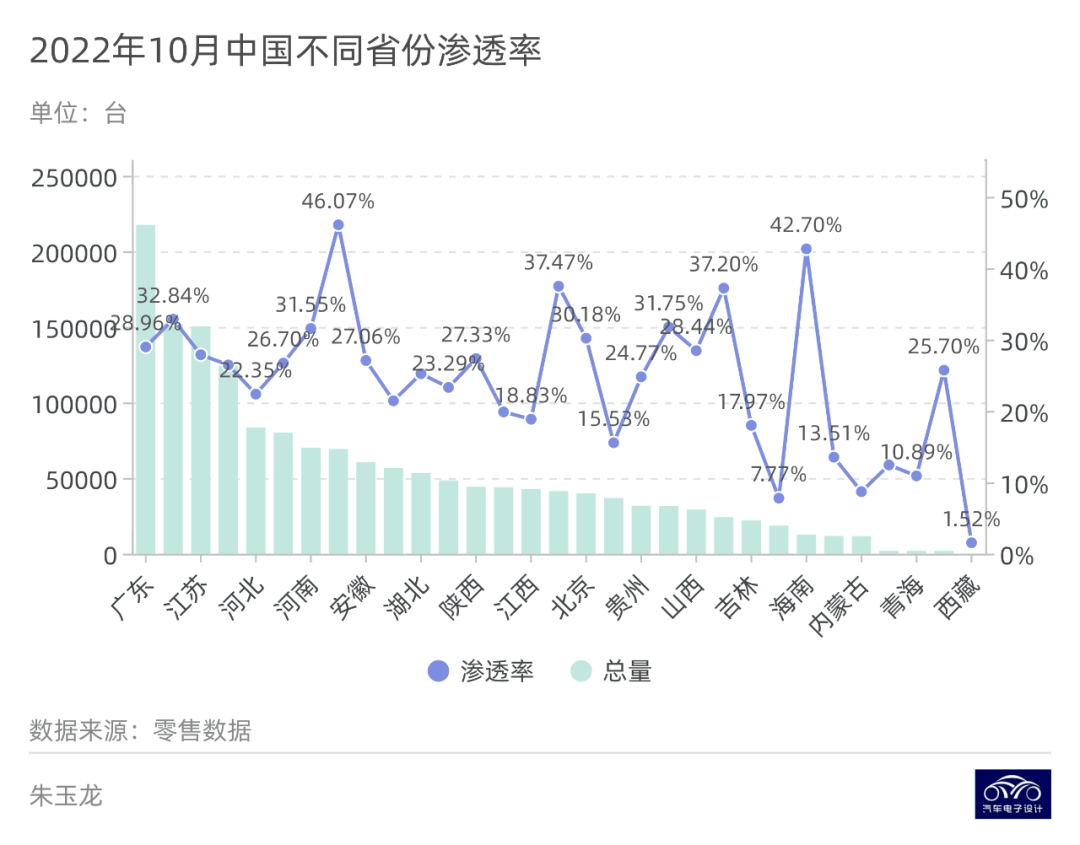

Permeability in terms of geographic latitude

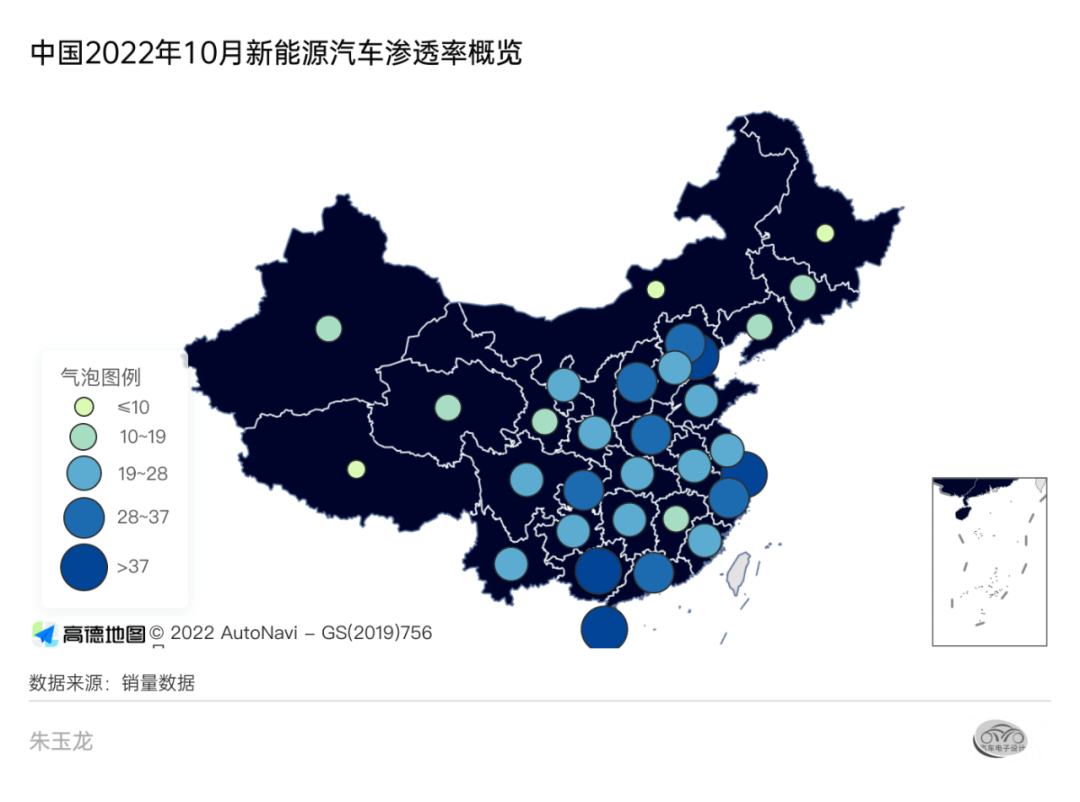

From the perspective of geographical latitude, the penetration rate of leading cities such as Beijing, Shanghai, Guangzhou, and Hainan with limited purchase policies is very high, and the coastal and central regions have a mild climate, which provides a convenient condition for the penetration of new energy vehicles. The areas with a penetration rate of less than 30% are mainly in the Midwest and Northeast. To achieve further penetration of new energy vehicles, in addition to the price level, geographical and climate constraints, as well as areas lacking in infrastructure, need to be considered.

This picture is a combination of sales volume and penetration rate. The current high penetration rate is also an objective reflection of the low total volume.

Part 4

Compared with major countries in the world, there is room for improvement in domestic penetration rate

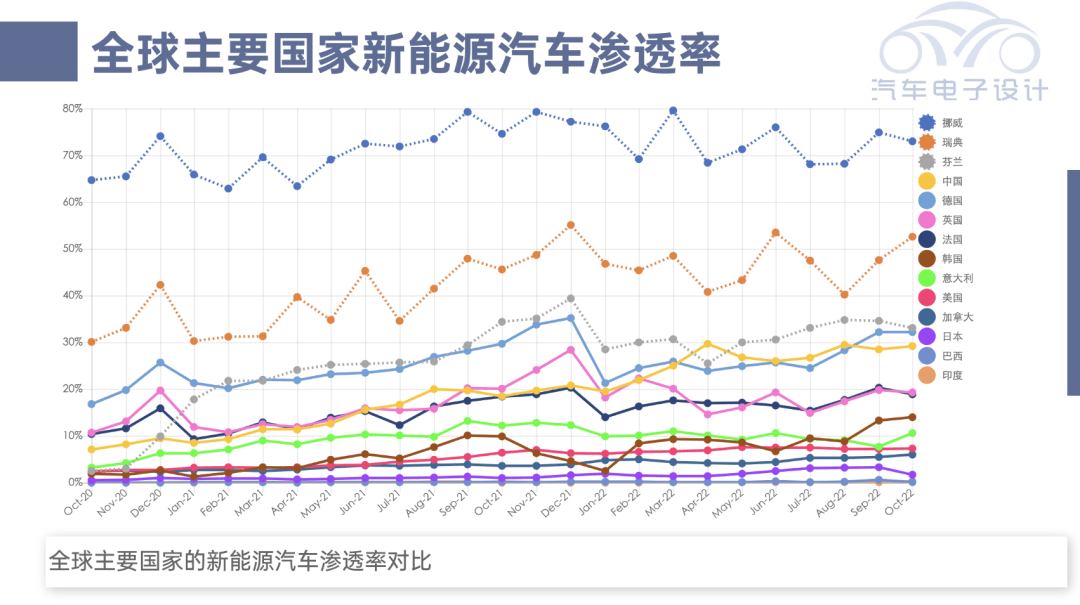

From the perspective of the penetration rate of new energy vehicles in the world, with the convergence of policies, we found that the sales of economies with relatively large sales bases are stuck at about 30% (Germany, China, and the United Kingdom) . China is under such a large base. It has already reached the top five in the world, and the results are already very good.

It is understandable that Sweden and Norway can break through this line in the short term. The market is small and the supply comes from all over the world.

The current global trend is that the penetration rate from 0% to 5% to 20% is easy to cross. This is mainly due to the fact that cutting-edge consumer groups around the world believe that electric vehicles are fashionable and "new" products. Consulting and investment institutions think so, car companies think so, and the government thinks so, and this awareness has been transmitted.

But to further improve the space, we have no way to compete with small markets like Sweden and Norway. I personally think that the overall penetration rate will be stable at this level, and there will be adjustments in each price segment.

Outlook: From 2023 to 2025

I personally think that from 2023 to 2025, after the penetration rate of new energy vehicles in China exceeds 30%, further improvement will be relatively slow. From a logical point of view, it is also very simple: With the reduction of subsidies starting in 2023 and the reduction of purchase tax in 2024, the two models with the largest sales volume in the Chinese passenger car market are currently 100,000-150,000 (31.90%) , and 150,000-200,000 (19.40%) , which itself is sensitive to price, is now stuck by the battery cost.

In the next three years, it will become increasingly difficult for fuel vehicles to make money, but the only way to reduce the cost of new energy vehicles is to make batteries smaller.

If the penetration rate is to be further improved, traditional car companies need to convert fuel vehicles into plug-in hybrids and extended-range hybrids, and they also need to further keep up with charging facilities. This is a long process of practicing internal skills.

XINDA

XINDA